Prerequisites

Sandbox

The sandbox replicates the live workflow so you can fully develop your integration before moving it to production.

Prerequisites:

- Obatin a test API Key

To work with the Sandbox, you only need a test API Key. Once you have the key, you can immediately experiment with the test environment; the entire live workload is replicated there. You obtain a free API Key just by signing up with the Invoicetronic API.

Live environment

- Obtain a live API Key

- Purchase API credits

- Register with Agenzia delle Entrate

- Enable regulation-compliant storage of your invoices

Once ready to move to the live environment, you must purchase some API credits first, then inform the Italian Revenue Service (Agenzia Entrate) that it should deliver your invoices through the Invoicetronic API. Also, you want some form of regulation-compliant storage of your invoices(1). The Agenzia Entrate website offers this service for free.

- The Invoicetronic API currently does not offer regulation-compliant storage of your invoices.

Below are step-by-step guides on registering with the Italian Revenue Service and enabling the regulation-compliant storage service on the Agenzia Entrate website.

Register with the Italian Revenue Service

To receive invoices on the Invoicetronic API, you must first register your Codice Destinatario 7HD37X0 in your Fatture e Corrispettivi area on the Agenzia delle Entrate website.

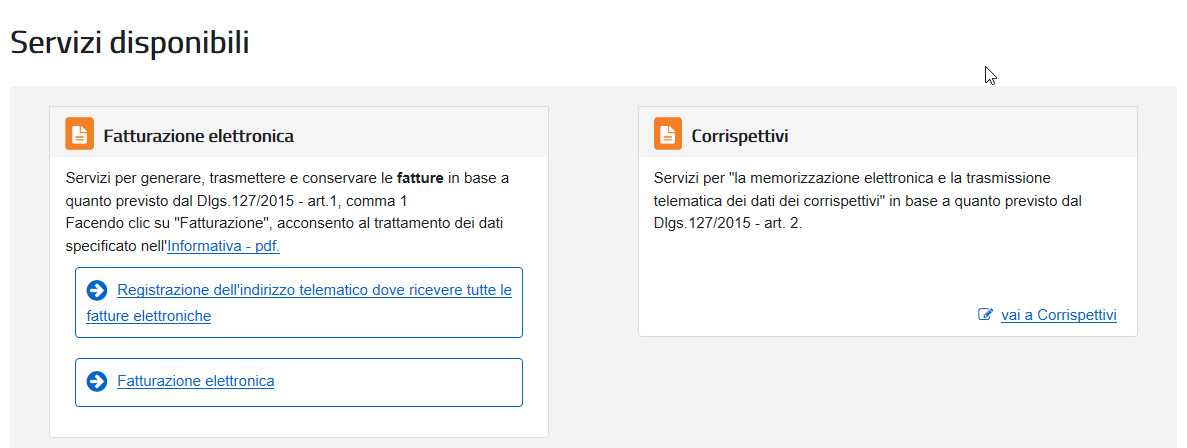

Log in to the restricted area with your credentials, your CNS, or your SPID. After a couple of steps where you select your account and agree to the Terms of Service, you land on this page:

Select Registrazione dell’indirizzo telematico dove ricevere tutte le fatture elettroniche, and you will come directly to the page where you can enter your Codice Destinatario.

Enter 7HD37X0 as the Codice Destinatario, and confirm. From now on, your incoming invoices will be delivered to the Invoicetronic API.

Create your companies before registering the Codice Destinatario

Before registering the Invoicetronic Codice Destinatario, make sure you have created all companies that will receive invoices via the company endpoint. Incoming invoices are automatically matched to the recipient company (CessionarioCommittente): if the company doesn't exist, the invoice will remain on hold until it is created. If you manage multiple companies, create all of them before proceeding with the registration.

No cutoff date needed

Once you register Invoicetronic's Codice Destinatario in Fatture e Corrispettivi, all your incoming invoices will be delivered to the Invoicetronic infrastructure—even those sent by vendors still using your previous recipient code. The Italian Revenue Service (SDI) automatically forwards invoices to your registered address, regardless of the code your vendors specify. This means there's no need for a hard cutoff date: your vendors can update their records gradually, or not at all. For more details, see the Switching providers guide.

Share your new Codice Destinatario

While SDI handles forwarding automatically, it's still a good practice to share your new Codice Destinatario with your vendors—especially new ones. This ensures invoices are addressed correctly from the start and avoids any potential delays from the forwarding process.

Operators managing multiple companies

Registration on the Agenzia delle Entrate website, as well as enabling regulation-compliant invoice storage, must be done by each client, in their own name. Italian companies usually already have access to the portal, or can easily obtain it—either directly or through their accountant. If you manage multiple clients, you can use your own Invoicetronic account and API keys for all of them, but each client must complete the registration on the Agenzia delle Entrate website following the instructions above. For more details, see the Switching providers guide.

Enable regulation-compliant storage of your invoices

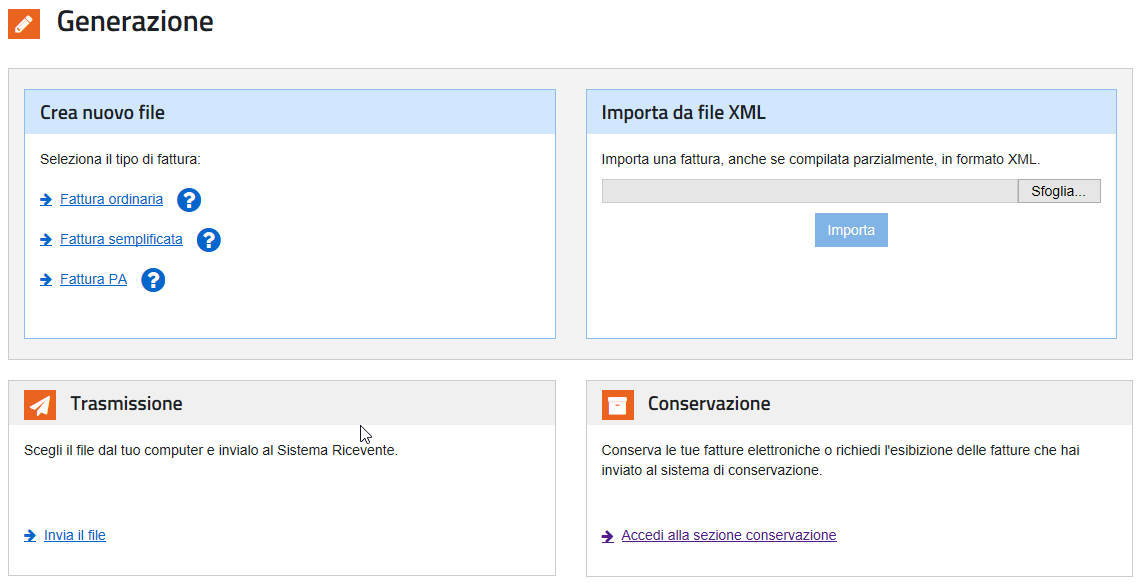

From the first page, click on Fatturazione Elettronica, and you will land on this page:

Choose the Accedi alla sezione conservazione option, and you will only have to agree to two blocks of contract terms to complete your membership in the service:

At this point, click Invia to complete the activation of the preservation service. From now on, all invoices sent to the Agenzia Entrate SDI system (through the Invoicetronic API) will be retained for 15 years on the Agenzia website.

Of course, all these steps can also be done by your advisor (accountant) with delegated authority for your normal tax activities, which most accountants already have.